Loan Management System

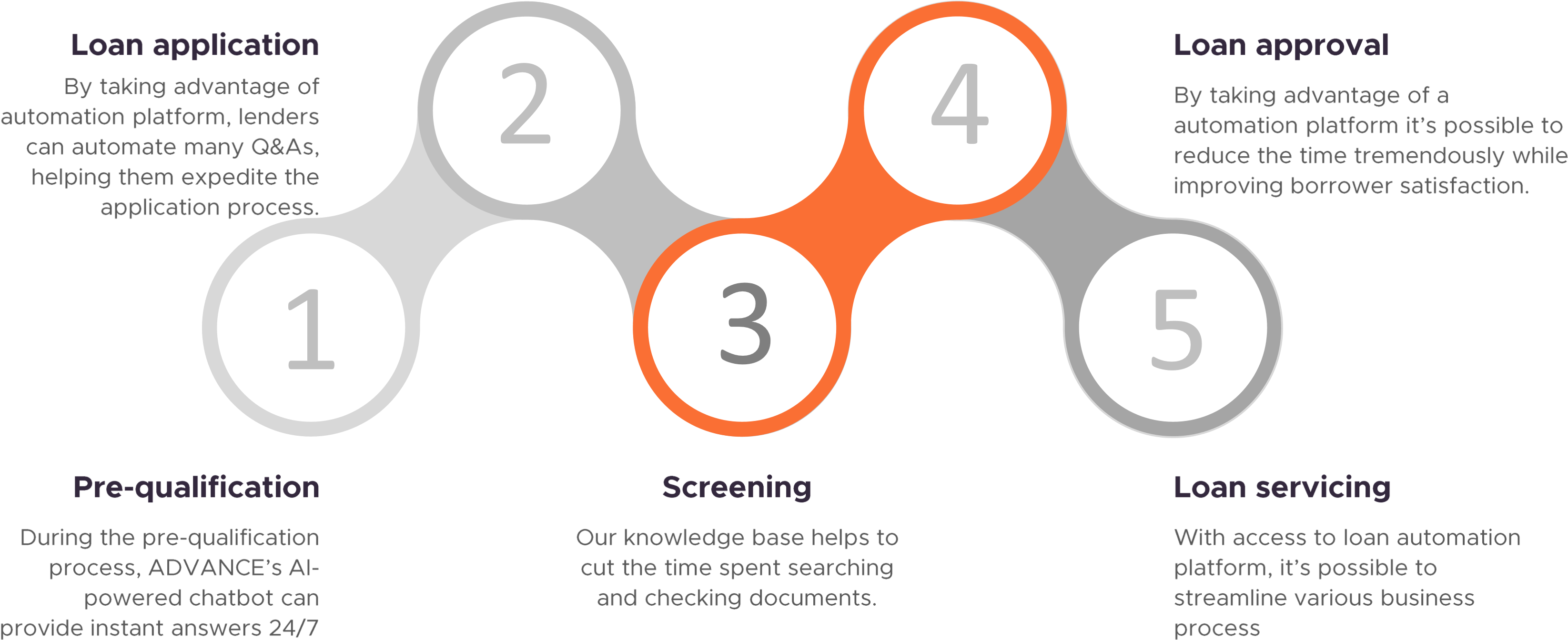

During the pre-qualification process, ADVANCE’s AI-powered chatbot can provide instant answers 24/7.

By taking advantage of automation platform, lenders can automate many Q&As, helping them expedite the application process.

Our knowledge base helps to cut the time spent searching and checking documents.

By taking advantage of a automation platform it’s possible to reduce the time tremendously while improving borrower satisfaction.

With access to loan automation platform, it’s possible to streamline various business process.

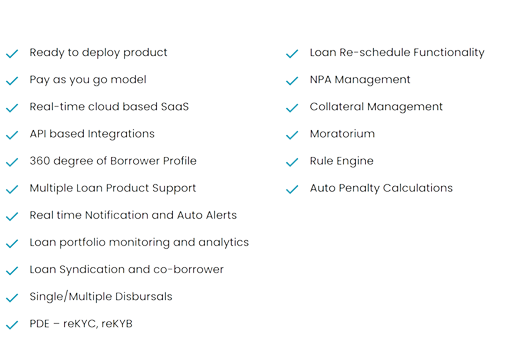

LMS can be accessed through REST API. It can be integrated with any downstream or upstream system, including core banking systems, accounting software, and consumer-facing apps.

LMS is a highly configurable platform and that too without coding requirements. the software can be configured with over 500 different parameters.

With an in-built reporting and analytics module, banks and financial institutions can extract, transform and analyze the LMS data. With REST APIs you can also pull the data to your portfolio.

With API-based LMS, banks and financial institutions can automate all their manual activities by integrating the systems to a single centralized platform.